About Mr. David Lê

Mr. David Lê is an entrepreneur with over 30 years of business experience in the United States.

He is a Main Street Certified Tax Advisor, certified by Mark Kohler and approved by the IRS.

With extensive expertise in taxation, real estate, and business management, Mr. David has helped hundreds of Vietnamese-American business owners and investors legally save from $10,000 to hundreds of thousands of dollars every year.

David’s mission is to bring the Vietnamese community smart, legal, and practical tax strategies—empowering families not only to keep more of their hard-earned money but also to build lasting financial freedom.

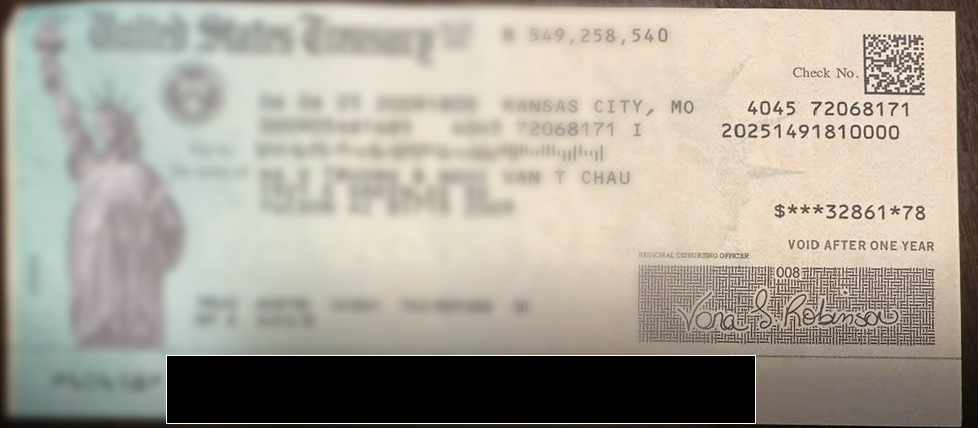

Testimonial

What Our Client Say

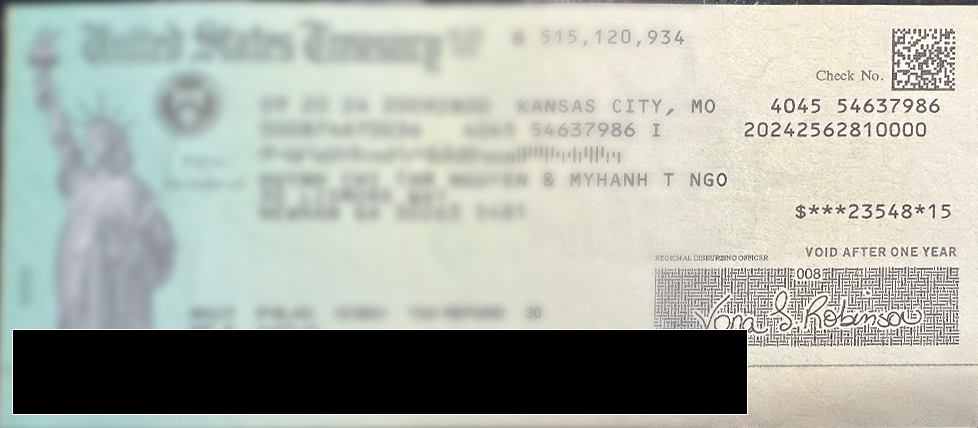

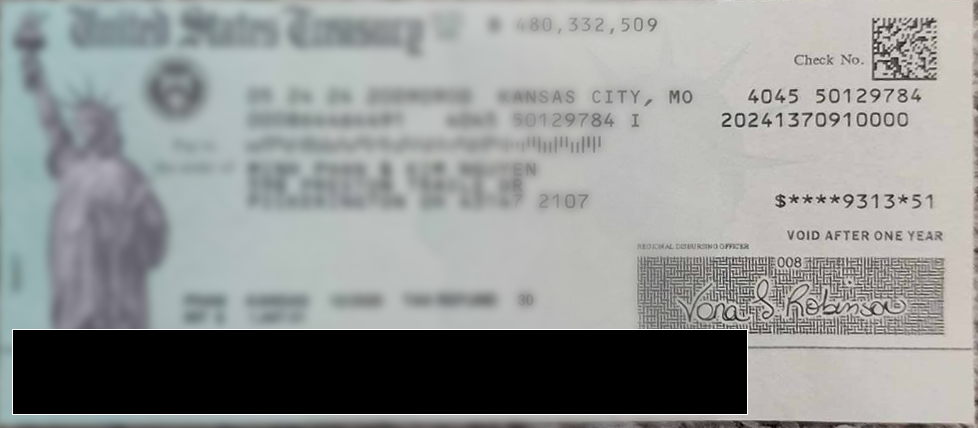

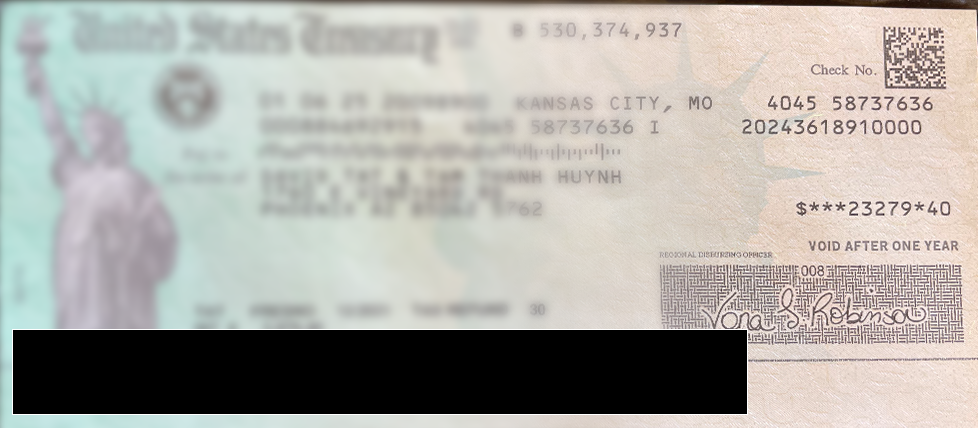

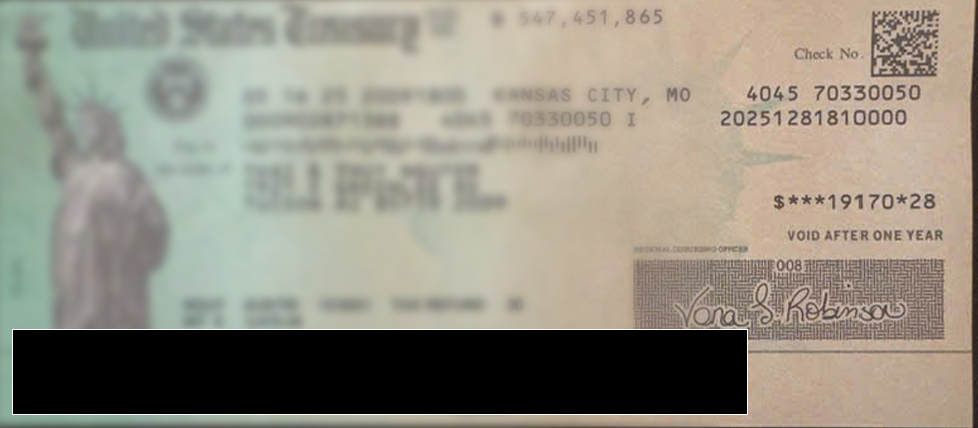

We have proudly partnered with our clients to help secure over $120 million

in tax credits and government-funded incentive programs administered by the IRS and other federal agencies.

How We Works

Four Steps to Optimize Your Tax

Make an Appointment

Book a private consultation to review your income, business structure, and current tax situation.

This first step helps us understand where you are today.

Schedule Meeting

We collect key financial details and prepare an initial tax assessment before the session.

This ensures our time together is focused and efficient.

Meet With Strategist

Meet one-on-one with a tax strategist to identify missed deductions, risks, and opportunities.

We outline clear ways to optimize your tax within legal guidelines.

Implement Your Strategy

You receive step-by-step guidance or full execution support, depending on your package.

Your tax is optimized to protect income and improve long-term efficiency.

Pricing Plans

Affordable Pricing Plans For You

Tax Assessment

$1,500

- Income-Based Assessment

- Missed Deductions Identified

- Self-Implementation Guidance

- Clarity Before Action

Tax Strategies

$5,000

- Everything in Assessment

- Strategy Setup & Execution

- Ongoing Follow-Up Support

- Expanded Tax Opportunities

Tax VIP

$7,000

- Everything in Strategies

- Full Execution Delegation

- Financial Structure Cleanup

- Family Role Optimization

- Our Capabilities

Are You Paying More Tax Than You Should?

Business Owner

You’re paying $55,000–$70,000+ in taxes every year, but without a clear tax plan, that number quietly grows as your income grows.

Over the next 12 months, missed deductions, poor structure, and reactive filing can cost you tens of thousands more — without you ever realizing where the money went.

W2 High Income

You earn well, but most of your income is taxed at the highest rates — and standard deductions barely make a dent.

Without proactive planning, the next year often means higher withholding, fewer options, and no leverage, even as your income increases.

Airbnb Business Owners

Most Airbnb hosts focus on increasing bookings —

but lose thousands every year due to poor structure, missed deductions, and zero long-term tax strategy.

We deliver a proven, Airbnb-specific framework that shows you how to optimize revenue, structure correctly, and legally deduct the full scope of eligible expenses — so your income grows without your tax bill growing with it.

- Our people

Rooted in Family, Guided by Vision

Le Financials was founded and is operated by the Lê family — a father and his three sons — representing two generations united by one vision:

To help the Vietnamese community in America manage their finances more wisely — through legal tax reduction, asset protection, and long-term wealth building.

By combining seasoned experience with a modern mindset, Le Financials is more than just a tax service provider — we are a trusted, long-term partner who understands and honors Vietnamese culture.

- Certified Tax Strategist

David Le

David Lê (Cường) is a trained Certified Tax Strategist, licensed through a program approved by the IRS.

With 25+ years of business experience, he has helped hundreds of clients save $10,000–$200,000+ in taxes each year.

He leads a team of over 15 specialists at Le Financials, helping Vietnamese clients in the U.S. legally reduce taxes, protect their assets, maximize profits, and build long-term financial plans.

- CPA & Corporate Tax Expert

Brandon Le

A graduate in Accounting from the University of Arizona, Brandon is a licensed CPA specializing in high-revenue businesses with annual income over $100 million. He oversees corporate bookkeeping, tax strategy, and the management of complex financial records.

- Financial Analyst & SMB Tax Specialist

Andrew Le

Holding a Finance degree from the University of Arizona, Andrew focuses on tax filing for self-employed individuals and small business owners (nail salons, restaurants, logistics, etc.). He integrates advanced software to streamline processes and enhance client experience.

- Business Systems & Client Success

Christopher Le

Graduated with a degree in Software Engineering from the University of Arizona.

Serving as the bridge between clients and tax professionals, Justin is responsible for system development, client operations, and supporting the implementation of optimized tax strategies for individuals and families.

Book Your Discovery Call with Le Financials

Have questions while putting your tax plan into action?

Our team is here to guide you — clearly and patiently.

Looking for long-term support? We also offer full-service financial planning to help you manage taxes, grow wealth, and protect your future.